Running your business without comparing it to others is like going to a hockey game and looking at your team’s score but not the opponent’s score. How do you know how well you are performing unless you compare to others? That is the essence of benchmarking. In this article, we will be discussing financial best practices from a 2017 study entitled Self-Employed Professionals and Small Business Owners in America. The study of 1700 small business owners found that only one in four owners used all seven best practices.

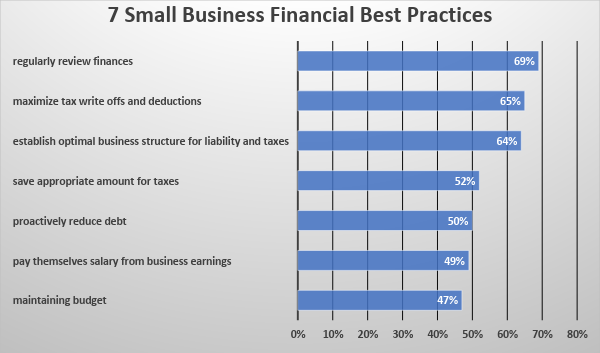

Internal benchmarking focuses on performance that is typically operational or financial. Best practices are one type of benchmarking that looks at leading companies and tries to identify common denominators. Below is a graphic that summarizes the results and what follows is an explanation that groups the tips into best practices categories.

2 Best Practices were related to finance and budget

- 69% regularly review finances

- 47% maintaining budget

Business 101 recommends that companies create a budget every year based on the goals of the business (how much you want to make), where the company is today (income, balance, debt, assets, liability, etc.) and how much it costs to achieve the goal. Business 201 recommends that companies monitor how well they are meeting that budget and Business 301 says make adjustments to ensure you meet as much as possible. Leading companies create budgets, monitor budgets and make adjusts to help maintain budgets.

3 Best Practices were related to taxes

- 64% establish optimal business structure for liability and taxes

- 65% maximize tax write-offs and deductions

- 52% save appropriate amount for taxes

When money is tight, it is not unusual to have checks earmarked for specific purposes. However, the best strategy is to immediately take a portion of each payment and put it away to tax payments. Between 30%-40% is a good rule of thumb for small businesses. This can be put into a business savings account. If you want to stay up-to-date on the latest tax write-offs and deductions you should consider setting up a Google Alert for “small business tax write-offs.”

In terms of the best business structure for liability and taxes, that is usually done when you start the business. At that point you need to research multiple websites. For Canadians, those include the getting started page, business structure page and maybe the income tax guide.

1 Best Practice on reducing debt

- 50% proactively reduce debt

An article entitled “Five Ways to Reduce Small Business Debt” on the Quickbooks site says that poor credit management, lack of money and personal use of business funds are the top reasons why small companies fail. The five tips they suggest are:

- Rework you budget if possible and adjust for changes in cash flow

- Reduce expenses by suspending or eliminating non-critical fees

- Increase sales by offering discounts or incentives

- Delay and prioritize debt payments

- Work with debt structuring firm to create a hardship letter

1 Best Practice involved owners paying themselves a salary

- 49% pay themselves salary from business earnings

Not all owners pay themselves but there are good arguments for paying yourself. Of course, there are tax implications that depend on your business structure too so check with your accountant.

Here are the some of the advantages of paying yourself.

- Psychologically it is what we are all used to, and it provides an incentive when you earn money as opposed to a motivation to quit when you are taking money out of savings.

- The money in the business is needed to grow the business and pay expenses, salaries and wages, taxes, equipment, rent, utilities etc.

- You will likely fly under the radar of the taxman. Drawing a regular salary is considered normal. Drawing nothing for a period of time and then withdrawing an unusually large amounts draws attention.

- Investors, banks and finance companies tend to look favorably on business owners who show consistent earnings and wages as opposed to occasional earnings and wages.

Why Adopt Best Practices?

There are no guarantees of success in business, but there are strategies that significantly increase your chances of success. Measuring performance, benchmarking, and adopting best practices are ways of increasing your chances of not only surviving but thriving.

If you’re a small business printer who wants to lower costs:

- Check out our article “Five Tips For Lowering Costs”

- Visit SinaLite. We offer outsource printing services at competitive, wholesale prices so that you can reduce production costs and grow your profits.

Great advice for any company, institution or cause.

Thanks, John. We’re glad to help!

Yes,I totally agree with what you said. I think that the money in the business is needed to grow the business and pay expenses, salaries and wages, taxes, equipment, rent, utilities etc.I think that business will not grow without money. Thanks for sharing this article.

Hi Mirriam, we’re glad you liked the article! Yes, money does indeed play an important role in many businesses as it’s one of the main things that drive us!